The Role Of Tax Amnesty In Moderating The Effect Of Taxpayer Commitment On Tax Compliance In Individual Taxpayers In Kudus Regency In 2022

DOI:

https://doi.org/10.51601/ijersc.v4i1.578Abstract

The research objective is to test tax compliance with tax amnesty which moderates the influence of the taxpayer's commitment to tax compliance. The research design uses causality research which serves to represent tax compliance. The research sample used individual taxpayers in Kudus Regency, amounting to 100 respondents. The results of the study explain that the commitment of taxpayers is not able to increase tax compliance. In addition, tax amnesty is capable of moderating which means strengthening the relationship between taxpayer commitments and tax compliance. However, individual taxpayers still perceive that the tax amnesty is not on target, so that in the end the government is advised to issue a tax amnesty policy in the future

Downloads

References

Ahn, T. K., & Wilson, R. K. (2010). Elinor Ostrom’s contributions to the experimental study of social

dilemmas. Public Choice, 143(3), 327–333. https://doi.org/10.1007/s11127-010-9623-8

Andreoni, J., & Diego, S. (2009). Compliance in der Unternehmerpraxis. Compliance in der

Unternehmerpraxis. https://doi.org/10.1007/978-3-8349-8282-7

Bela, M. G. S. (2017). Locus Of Control Sebagai Pemoderasi Pengaruh Komitmen Organisasional dan

Tunjangan Kinerja Terhadap Kinerja Pegawai Pajak.

Bicchieri, C., & Lev-on, A. (2007). Computer-mediated communication and cooperation in social dilemmas: An

experimental analysis. Politics, Philosophy & Economics, 6(2), 139–168.

https://doi.org/10.1177/1470594X07077267

Devos, K. (2014). Factors influencing individual taxpayer compliance behaviour. Factors Influencing Individual

Taxpayer Compliance Behaviour, 9789400774766, 1–342. https://doi.org/10.1007/978-94-007-7476-6

Dunarea, U., & Galati, D. J. (2013). A Review of Factors impacting Tax Compliance. Australian Journal of

Basic and Applied Sciences, (June), 476–479.

Dwenger, N., Kleven, H., Rasul, I., & Rincke, J. (2016). Extrinsic and intrinsic motivations for tax compliance:

Evidence from a field experiment in Germany. American Economic Journal: Economic Policy, 8(3), 203–232.

https://doi.org/10.1257/pol.20150083

Chandrarin, Grahita. 2017. Quantitative Approach Accounting Research Methods, Salemba Four, Jakarta.

Feld, L. P., & Savioz, M. R. (1997). Direct democracy matters for economic performance: An empirical

investigation. Kyklos, 50(4), 507–538. https://doi.org/10.1111/1467-6435.00028

Gangl, K., Hofmann, E., Groot, M. De, Antonides, G., Hartl, B., & Kirchler, E. (n.d.). Taxpayers ’ Motivations

Relating to Tax Compliance : Evidence from Two Representative Samples of Austrian and Dutch SelfEmployed Taxpayers, 15–25.

Gerger, G. C. (2012). Tax Amnesties And Tax Compliance In Turkey. International Journal of

Multidisciplinary Thought, 2(3), 107–113.

Hakim, Z., Handajani, L., Inapty, B. A., Ekonomi, F., Mataram, U., Koessler, A. K., … Young, H. (2017). The

Effect of Tax Amnesty, Tax Knowledge, And Fiscus Services On Taxpayer Compliance. Going Concern :

Journal of Accounting Research, 2(2), 124–133. https://doi.org/10.32400/gc.12.2.17480.2017

Harmon-Jones, E. (2012). Cognitive Dissonance Theory. Encyclopedia of Human Behavior: Second Edition,

(January), 543–549. https://doi.org/10.1016/B978-0-12-375000-6.00097-5

Hurkens, S., & Kartik, N. (2009). Would i lie to you? on social preferences and lying aversion. Experimental

Economics, 12(2), 180–192. https://doi.org/10.1007/s10683-008-9208-2

Husnurrosyidah, & Nuraini, U. (2017). The Effect Of Tax Amnesty And Tax Sanctions On Tax Compliance In

Bmt Se-Karesidenan Pati. Syntax Literate : Indonesian Scientific Journal, 2(3), 124–133.

Internal Revenue Service. (2012). Internal Revenue Service Data Book, 2012, 1–76.

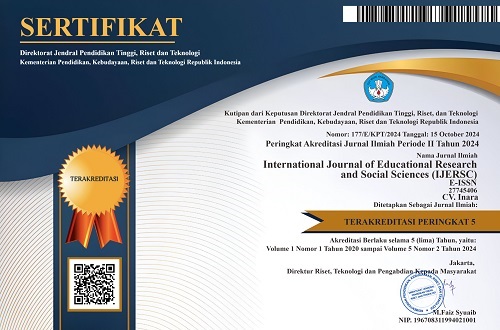

International Journal of Educational Research & Social Sciences ISSN: 2774-5406

James, S., & Alley, C. (2009). Tax Compliance , Self-Assessment and Tax Administration School of Business

and Economics , University of Exeter. Journal of Finance and Management in Public Services, 2(2), 27–42.

Kledung, K., & Cliffs, E. (2012). Daftar pustaka.

Koessler, A. K., Torgler, B., Feld, L., & Bruno, S. (n.d.). Commitment to Pay Taxes : A Field Experiment on the

Importance of Promise A F IELD E XPERIMENT ON THE I MPORTANCE OF.

Kristin, Yohana Sara, A. S. (2013). Account Representative Employees at Kpp Pratama Surabaya Rungkut. T a

X & a C C Ou N T I N G R E V I Ew, 3(2).

Lars, P., & Bruno, S. (2018). www.econstor.eu.

Mahestyanti, P., Juanda, B., & Anggraeni, L. (2018). The Determinants of Tax Compliance in Tax Amnesty

Programs: Experimental Approach. Etikonomi, 17(1), 93–110. https://doi.org/10.15408/etk.v17i1.6966

Malik, O. F., Waheed, A., & Malik, K.-U.-R. (2010). The Mediating Effects of Job Satisfaction on Role

Stressors and Affective Commitment. International Journal of Business and Management, 5(11).

https://doi.org/10.5539/ijbm.v5n11p223

Mattiello, G. (2005). Multiple tax amnesties and tax compliance ( Forgiving seventy times seven ). Working

Paper 06/2005 , Dipartimento Di Scienze Economiche S. Giobbe-Cannaregio 873 30121 Venezia (Italia), 1–22.

Nurkhin, A., Novanty, I., Muhsin, M., & Sumiadji, S. (2018). The Influence of Tax Understanding, Tax

Awareness and Tax Amnesty toward Taxpayer Compliance. Jurnal Keuangan Dan Perbankan, 22(2), 240–

https://doi.org/10.26905/jkdp.v22i2.1678

Oliver, J. (2019). No Title. Hilos Tensados, 1, 1–476. https://doi.org/10.1017/CBO9781107415324.004.

Rahmawati, R., & Yulianto, A. (2018). Analysis of the Factors Affecting Individual Taxpayers Compliance.

Accounting Analysis Journal, 7(1), 17–24. https://doi.org/10.15294/aaj.v5i3.18411

Rothenberg, A. (1988). Additive and nonadditive factors in creative processes. Journal of Social and Biological

Systems (Vol. 11). https://doi.org/10.1016/0140-1750(88)90050-4

Sakurai, Y., & Braithwaite, V. (2003). Taxpayers’ Perceptions of Practitioners: Finding One Who is Effective

and Does the Right Thing? Journal of Business Ethics, 46(4), 375–387.

https://doi.org/10.1023/A:1025641518700

Saraçoğlu, O. F., & Çaşkurlu, E. (2011). Tax Amnesty with Effects and Effecting Aspects: Tax Compliance, Tax

Audits and Enforcements Around; The Turkish Case. International Journal of Business and Social Science,

(7), 95–103. https://doi.org/Doi 10.3866/Pku.Whxb201304222

Sari, R. I., & Nuswantara, D. A. (2017). The Influence of Tax Amnesty Benefit Perception to Taxpayer

Compliance. Jurnal Dinamika Akuntansi, 9(2), 176–183. https://doi.org/10.15294/jda.v9i2.11991

Sarker, S., & Wells, J. D. (2003). Understanding mobile handheld device use and adoption. Communications of

the ACM, 46(12), 35–40. https://doi.org/10.1145/953460.953484

Schrodt, H. (2011). Entwicklungslinien genderkompetenter Schulprozesse: ein Pionierbericht aus Österreich.

Genderkompetenz Und Schulwelten, 7(1), 193–206. https://doi.org/10.1007/978-3-531-92674-2_11

Siahaan, F. (2005). The Influence Of Tax Fairness, Ethical Attitudes And Commitment On Taxpayer

Compliance Behavior, 13(1), 33–44.

Siregar, S. V., Amarullah, F., Wibowo, A., & Anggraita, V. (2012). Audit tenure, auditor rotation, and audit

quality: The case of Indonesia. Asian Journal of Business and Accounting, 5(1), 55–74.

Surat, A., Spt, P., Pada, P., Restoran, D. A. N., & Semarang, D. I. (n.d.). Comparative Analysis of Taxpayer

Commitments In Mel-, 1–19.

Tax Morale, Influencing Factors, Evaluation Opportunities And Problems: The Case Of Estonia Kerly Lillemets

Tallinn University of Technology. (2006), (Scmölders), 233–252.

Taxpayers Knowledge: a Descriptive Evidence on Demographic Factors in Malaysia. (2005). Jurnal Akuntansi

Dan Keuangan, 7(1), 11–21. https://doi.org/10.9744/jak.7.1.pp.11-21

Thabane, L. J., Radebe, P. Q., & Dhurup, M. (2018). The Effect of Job Satisfaction on the Organisational

Commitment of Administrators. Journal of Economics and Behavioral Studies, 9(6), 188.

https://doi.org/10.22610/jebs.v9i6.2015

Torgler, B., & Schneider, F. (2007). Shadow Economy, Tax Morale, Governance and Institutional Quality: A

Panel Analysis, 2007(04).

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 International Journal of Educational Research and Social Sciences (IJERSC)

This work is licensed under a Creative Commons Attribution 4.0 International License.